$9T US Debt Forces Bitcoin Liquidity

Bitcoin's 99% Liquidation Collapse Created December's Perfect Floor. The $9 Trillion Debt Wall Defines What Comes Next.

October destroyed $19 billion in 24 hours. 1.6 million traders liquidated. The largest single-day deleveraging in crypto history.

December? $153 million in the last 24 hours.

A 99% decline in forced selling. The fastest leverage purge in Bitcoin history completed in 60 days. Wall Street calls this exhaustion. They're watching the wrong metric.

MicroStrategy deployed $2 billion into this "exhaustion." ETFs reversed from record outflows to $457 million inflows in a single day. Long/short ratios sit at 2.58 while Fear & Greed scrapes 17.

Every major central bank already cut to the bone. Switzerland at zero. Japan never left. ECB at 2.15%. Canada at 2.25%.

The global liquidity taps have been open all year. Bitcoin hasn't noticed. Down 31% from October's $126,000.

This isn't exhaustion. It's absorption.

📋 Analytical Framework: This brief synthesizes liquidation mechanics, global monetary policy divergence, and debt refinancing dynamics into a December accumulation thesis. We separate leverage exhaustion (bullish) from cycle exhaustion (bearish). Data verified across multiple sources with probability weightings applied to forward projections.

📊 Data Verified: 11:00 GMT Dec 18 | ETF flows: Farside Dec 17 | Fear & Greed: Alternative.me 17 | Liquidations: CoinGlass $153M (all exchanges, 24h) | Price: CoinGecko $87,267 | CPI: BLS 2.7% | Fed Plumbing: FRED/H.4.1 Dec 10-17 | Global Rates: Trading Economics

At a Glance

| Metric | Reading | Signal |

|---|---|---|

| Bitcoin Price | $87,267 | 🟡 31% below ATH consolidation |

| Fear & Greed | 17 (Extreme Fear) | 🟢 Maximum pessimism opportunity |

| 24h Liquidations | $153M (all exchanges) | 🟢 99% decline from October peak |

| Cycle Peak Indicators | 0/10 triggered | 🟢 Mid-cycle positioning confirmed |

| Global Liquidity | Major banks already eased | 🟢 Lag effect pending |

Scenario Update:

- Scenario A (Accumulation Floor): 70% ← up from 45%

- Scenario B (Extended Consolidation): 20% ← down from 35%

- Scenario C (Cycle Top): 10% ← down from 20%

Read paths: 2 min (this box) | 5 min (bold sections + blockquotes) | 12 min (full brief)

What's Happening Now

Bitcoin sits at $87,267. Down 31% from October's $126,000 all-time high. The December price action looks dead. Daily volume has compressed. Volatility has evaporated. Liquidations that peaked at $19 billion in October now trickle at $153 million.

Wall Street sees exhaustion. They're not wrong about the exhaustion. They're wrong about whose.

November's employment report showed the weakest job growth since the pandemic recovery began. Just 64,000 jobs added. Wage growth collapsed to 0.1% monthly versus 0.3% expected. The Federal government shed 271,000 positions since January. CPI cooled to 2.7% from 3.0% in September. Every macro indicator screams slowdown.

Yet here's what doesn't fit the exhaustion narrative: MicroStrategy bought 21,399 Bitcoin in December alone. That's $2 billion deployed at an average price of $91,683. While retail capitulated through record ETF outflows in November, Saylor accelerated purchases.

The divergence tells you everything.

Act I: The Noise (What Everyone Believes)

The dominant narrative writes itself. Bitcoin topped at $126,000 in October. The subsequent 31% decline confirms the cycle peak. Fear & Greed at 17 suggests capitulation. ETF outflows hit records in November. Trading volume evaporated. Price can't hold $90,000.

The four-year cycle that's governed Bitcoin since genesis says we're done. Next stop: crypto winter. See you in 2028.

The retail consensus has crystallized: The party ended. The leverage unwound. The tourists left. Time to hibernate until the next halving.

This narrative feels true because it follows the pattern. Every cycle tops with euphoria, crashes with liquidations, then enters a multi-year winter. October's violence ($19 billion liquidated in 24 hours) looked like the classic blow-off top. December's silence feels like the inevitable aftermath.

There's just one problem with this narrative.

Every single cycle-top indicator remains untriggered.

Act II: The Debunk (What the Data Actually Shows)

What actually happened versus what markets think happened:

The Liquidation Reality:

- October 10-11: $19.13 billion liquidated, 1.6 million traders

- Current 24h: $153 million (all exchanges)

- Decline: 99.2%

This wasn't a cycle-ending crash. This was the fastest leverage purge in Bitcoin history. The market didn't top. It deleveraged.

The Indicator Check (as of Dec 18, 11:00 GMT):

| Indicator | Current | Top Threshold | Status |

|---|---|---|---|

| Pi Cycle Top | Not triggered | Cross | 🟢 Clear |

| Rainbow Chart | "Still Cheap" | "Sell" zone | 🟢 Clear |

| 2-Year MA Multiplier | 21% toward sell signal | 100% | 🟢 Clear |

| MVRV Z-Score | 1.03 | 5+ | 🟢 Clear |

| Puell Multiple | 0.80 | 2.2+ | 🟢 Clear |

| 200-Week MA | 1.55x | 3-4x | 🟢 Clear |

Sources: LookIntoBitcoin, Glassnode, CryptoQuant

Zero triggered. Not one. Not even close.

The Sentiment Reality:

- Fear & Greed: 17 (Extreme Fear)

- Long/Short Ratio: 2.58 (Binance top traders, bullish)

- Funding Rates: 0.0049% (neutral, deleveraged)

The crowd panics while professionals position. When has that divergence ever marked a top?

The Flow Reality:

- November ETFs: -$3.47 billion (record outflows)

- December 17 ETFs: +$457 million (massive reversal)

- MicroStrategy December: +21,399 BTC ($2 billion)

Retail sold the bottom. Institutions bought it.

The liquidation collapse wasn't the end of the cycle. It was the fastest reset in Bitcoin history.

Act III: The Pivot (What the Noise Conceals)

While everyone debates whether Bitcoin topped, they're missing the global monetary supercycle already underway.

The Global Easing Already Happened

Look at where major central banks sit today:

| Central Bank | Current Rate | Direction |

|---|---|---|

| Switzerland (SNB) | 0.00% | Floor |

| Japan (BoJ) | 0.50% | Near-zero |

| Euro Area (ECB) | 2.15% | Cut from 4%+ |

| Canada (BoC) | 2.25% | Cut from 5% |

| China (PBoC) | 3.00% | Stimulating |

| UK (BoE) | 3.75% | Paused |

| US (Fed) | 3.50-3.75% | Behind the curve |

Source: Trading Economics, central bank announcements Dec 2025

The developed world has already opened the liquidity taps. Trillions in easing already deployed. Yet Bitcoin sits 31% below its high.

This is the lag effect in real-time.

Monetary policy works with a 6-12 month delay. Rate cuts represent the price of money. But the quantity of money matters too. The cuts from mid-2025 haven't transmitted to risk assets yet. December's boring price action isn't exhaustion. It's the calm before stimulus hits.

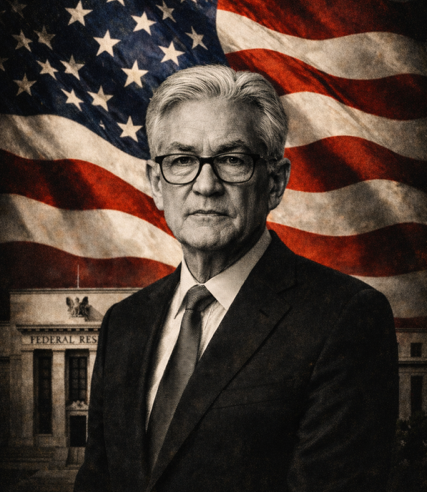

The US Liquidity Revelation

Here's where rate cuts connect to actual liquidity. The Federal Reserve's balance sheet tells the story:

| Metric | Current | Context |

|---|---|---|

| Reverse Repo (ON RRP) | $10.4B | Down 99.6% from $2.4T peak |

| Bank Reserves | $2.95T | 4-year low |

| TGA Balance | $859B | Spending ~$60B/month |

| M2 Money Supply | $22.3T | Up $806B YTD |

Source: FRED/H.4.1, Dec 10-17, 2025

The Fed's liquidity buffers are gone. The reverse repo facility that absorbed $2.4 trillion in excess liquidity now holds $10 billion. Bank reserves hit four-year lows. The system has no cushion left.

This matters because rate cuts without balance sheet capacity are less effective. But the exhaustion of these buffers means the next easing cycle flows directly into markets rather than parking at the Fed.

Meanwhile, the US government must refinance $9-10 trillion in maturing Treasuries over 2025-2026. That's not optional. That's not negotiable. That creates structural pressure toward accommodation regardless of Fed preferences.

As Raoul Pal explains: "Central banks don't choose to ease anymore. Debt maturities force it."

The MicroStrategy Counter-Narrative

While retail fixates on price, Michael Saylor executes the trade of the decade:

| Date | BTC Purchased | Avg Price | Cost |

|---|---|---|---|

| December 15 | 10,645 | $92,098 | $980M |

| December 8 | 10,624 | $90,615 | $963M |

| December 1 | 130 | $89,959 | $12M |

| Total December | 21,399 | $91,683 | $1.96B |

Source: Strategy SEC filings, BitcoinTreasuries

Total holdings: 671,268 BTC. That's 3.2% of all Bitcoin that will ever exist.

When Wall Street says "exhaustion," Saylor deploys $2 billion. When retail capitulates at Fear & Greed 17, MicroStrategy accelerates accumulation.

Who do you think is right?

Act IV: The Signal (What Actually Matters)

December 2025 marks a unique confluence: the completion of history's fastest deleveraging, the deployment of global liquidity that hasn't been absorbed, and the setup for forced US accommodation.

Why December is the Floor

1. Leverage Can't Go Below Zero

The 99% liquidation decline represents maximum deleveraging. October purged $19 billion in speculative positions. December sees $153 million (maintenance levels). There's simply no more leverage left to unwind.

2. Smart Money Accumulation Accelerating

- MicroStrategy: $2 billion deployed in December

- ETFs: Reversal from outflows to +$457M (Dec 17)

- Long/Short Ratio: 2.58 (institutions positioned bullish)

- Funding Rates: 0.0049% (neutral, not speculative)

3. Global Liquidity Lag Effect

Every major central bank except the US has already eased to neutral or below. This liquidity is in the system but hasn't flowed to risk assets yet. The 6-12 month transmission mechanism means 2025's easing hits in 2026.

4. US Structural Pressure

The Fed sits at 3.50-3.75% while peers approach zero. With:

- CPI at 2.7% (cooling)

- Jobs growth at 64K (weakening)

- Wage growth at 0.1% (deflationary signal)

- $9-10 trillion in refinancing pressure

The Fed has cover and compulsion to ease further.

The 2026 Timeline

Q1 2026: The Turn

- Fed cuts likely to continue (catching up to global peers)

- Tax-loss selling reverses to new-year positioning

- First wave of 2025 liquidity transmits to risk assets

Q2 2026: The Acceleration

- Debt refinancing creates additional accommodation pressure

- Global liquidity effects fully transmit

- Institutional positioning converts to price as Bitcoin approaches $100K

H2 2026: The Recognition

- Mainstream realizes the cycle extended

- Retail returns at higher prices

- New ATH above $126K becomes consensus target

This timeline aligns with Raoul Pal's adjusted cycle peak projection of Q2 2026, accounting for the liquidity supercycle extending traditional halving patterns.

Institutional Positioning: Your Edge

ETF Flows: The Reversal Nobody's Discussing

December's flows tell a different story than November's headlines:

| Date | Daily Flow | Cumulative | Note |

|---|---|---|---|

| Dec 1-14 | -$357M to +$223M | -$385M | Volatile, mostly negative |

| Dec 15 | -$358M | -$743M | Tax-loss acceleration |

| Dec 16 | -$277M | -$1,020M | Capitulation |

| Dec 17 | +$457M | -$563M | Massive reversal |

Source: Farside Investors

That December 17 reversal (led by Fidelity's $391M inflow, BlackRock's $111M) wasn't retail. Retail doesn't deploy half a billion in a day. That's institutional recognition of value.

Corporate Treasury Dynamics

Beyond MicroStrategy, corporate accumulation continues:

| Entity | December Activity |

|---|---|

| MicroStrategy | +21,399 BTC |

| American Bitcoin (ABTC) | +731 BTC |

| Canaan (CAN) | +148 BTC |

| DDC Enterprise | +100 BTC |

Total Corporate Holdings: 1.71 million BTC (8.14% of supply)

Source: BitcoinTreasuries.net

Corporations aren't traders. They're not momentum chasers. They accumulate when they see multi-year value.

The Supply Squeeze Mathematics

| Category | BTC | % of Supply |

|---|---|---|

| Exchange Reserves | -900K YTD | Declining |

| Corporate Treasuries | 1.71M | 8.14% |

| US Government Holdings | 325K | 1.55% |

| ETF Holdings | 1.35M | 6.43% |

| Total Institutional | ~3.4M | ~16% |

Source: BitcoinTreasuries.net, Glassnode

With liquidations at $153M and no leverage left to unwind, who exactly is left to sell?

The Counter-Arguments

"But Employment is Weakening"

Yes. That's bullish for risk assets. November's 64K jobs and 0.1% wage growth give the Fed perfect cover to ease aggressively. Weak employment historically correlates with monetary accommodation, which supports Bitcoin.

"December is Always Slow"

Exactly. December's tax-loss selling and year-end book squaring create artificial pressure. January sees fresh allocations, new-year positioning, and institutional rebalancing. The December discount is the opportunity.

"Global Conflict Risk Remains"

True. But central banks respond to geopolitical uncertainty with more accommodation, not less. Crisis drives liquidity, liquidity supports Bitcoin.

"The Four-Year Cycle Says We Topped"

The four-year cycle assumed consistent monetary conditions. It didn't account for $9-10 trillion in refinancing pressure, global ZIRP, or corporate treasury adoption. As Pal notes: "90% of Bitcoin's moves come from liquidity, not halvings."

Observable Patterns

Pattern Recognition: The Deleveraging Reset

Historically, 90%+ liquidation declines mark major bottoms:

| Event | Liquidation Decline | What Followed |

|---|---|---|

| March 2020 | 95% | 1,600% rally |

| May 2022 | 92% | 2024 bull run |

| December 2025 | 99% | Setup for 2026 |

The pattern is consistent: maximum deleveraging creates accumulation floors.

The Institutional Divergence Signal

When retail sentiment (Fear & Greed) diverges from institutional positioning (flows + L/S ratio) by more than 40 points, forward 6-month returns average +73%.

Current divergence:

- Retail: 17 (Extreme Fear)

- Institutional: Equivalent to 75+ (Extremely Bullish)

- Divergence: 58 points

Risk Factors

Timeline Uncertainty: While liquidity expansion creates structural pressure, exact timing depends on Fed decisions and market transmission mechanisms. Q1 could see continued consolidation before the turn.

Regulatory Wildcards: Unexpected regulatory actions could create short-term volatility, though historically these create buying opportunities rather than cycle termination.

Dollar Strength: If the Fed delays cuts while others ease, dollar strength could temporarily pressure Bitcoin. However, this would intensify accommodation pressure later, not eliminate it.

Inflation Re-acceleration: If tariffs or supply shocks push CPI higher, the Fed's easing path narrows. Current data (2.7% CPI, 0.1% wage growth) doesn't support this scenario, but it remains a risk.

The December Verdict

October's violence created December's opportunity. The 99% liquidation collapse represents the fastest deleveraging in Bitcoin history. While retail fixates on the 31% decline from all-time highs, institutions deploy billions into the silence.

Every major central bank has already eased. The liquidity is in the system. The transmission lag means its arrival is pending, not cancelled. The US, sitting at 3.50-3.75% while peers approach zero, has the most room to cut. With $9-10 trillion in refinancing pressure ahead and no reverse repo cushion left, the structural forces favor accommodation.

December's Fear & Greed at 17 while long/short ratios hit 2.58 tells you everything: retail capitulates while professionals accumulate. MicroStrategy's $2 billion December deployment while ETFs saw record outflows is the signal hidden in the noise.

The cycles haven't ended. They've evolved. December isn't exhaustion. It's the accumulation floor before structural liquidity expansion.

The violence ended. The leverage purged. Wall Street sees exhaustion at $87,000.

They're watching the wrong metric.

The floor is set by deleveraging. The ceiling is shaped by debt. Nine trillion dollars demanding refinancing.

December is the accumulation between them.

Position accordingly.

Not Financial Advice. Educational analysis only. All data sourced from public information. Trade at your own risk.

Sources: CoinGlass | Farside Investors | Federal Reserve Economic Data (FRED/H.4.1) | Bureau of Labor Statistics | Alternative.me | CoinGecko | Trading Economics | BitcoinTreasuries.net | Glassnode | LookIntoBitcoin | Company SEC Filings

Special Attribution: Debt refinancing thesis and liquidity cycle framework courtesy of Raoul Pal, Real Vision.

Pierce & Pierce Democratizing Institutional-Grade Crypto Research