Ground Truth: U.S. Crypto Policy

Every crypto bill, reserve, and policy shift explained. The context that defines the next 12 months.

Nation-states stopped selling Bitcoin.

The United States holds 325,000 BTC. Policy-locked. Never for sale. Texas just bought Bitcoin with taxpayer money. First state in American history. The first major crypto law was signed in July. A market structure bill cleared the House with 294 votes.

This happened in twelve months.

Not twelve years. Twelve months.

We spent a decade waiting for the institutional green light. In July, it turned green. In November, Texas stepped on the gas.

The market priced the events. It hasn’t priced the compounding flow. ETF approval was January 2024. Inflows took 12 months to hit $100B+. The GENIUS Act signing was the event. The slow-drip institutional adoption that follows is the trade.

Retail is watching the 15-minute chart. Smart money is reading the Federal Register.

This brief is your complete guide: what’s law, what’s pending, what’s hype, and why it matters for positioning.

📋 Analytical Framework: This brief consolidates the current state of U.S. crypto legislation, separating confirmed law from pending bills from executive action. We connect policy developments to structural supply dynamics. Treat pending legislation as probability, not certainty.

📊 Data Verified: December 14, 2025 | Legislative status: Congress.gov | Holdings: Arkham Intelligence | Stablecoins: DefiLlama | Price: CoinGecko

At a Glance

| Legislation | Status | Signal |

|---|---|---|

| GENIUS Act | ✅ LAW | 🟢 Stablecoin infrastructure secured |

| Strategic Bitcoin Reserve | ✅ ACTIVE (EO) | 🟡 325K BTC supply removed. Reversible. |

| Texas Reserve | ✅ FUNDED | 🟢 State adoption pilot proven |

| CLARITY Act | ⏳ SENATE | 🟡 Market structure clarity coming |

| BITCOIN Act | ⏳ COMMITTEE | 🔴 No momentum |

| Bitcoin for America Act | ⏳ COMMITTEE | 🔴 Very early stage |

The Structural Picture:

| Metric | December 2024 | December 2025 | Change |

|---|---|---|---|

| Federal BTC holdings | Auctioning seized assets | 325K BTC, never selling | 🟢 Seller → Holder |

| Major crypto laws | Zero | GENIUS Act signed | 🟢 First ever |

| State Bitcoin purchases | None in history | Texas deployed $5M | 🟢 Pilot launched |

| SEC posture | Suing exchanges | Crypto Task Force | 🟢 Enforcement → Rulemaking |

| Market structure bill | Dead | 294 House votes | 🟢 Bipartisan momentum |

Read paths: 2 min (this dashboard) | 6 min (bold sections) | 12 min (full brief)

Part 1: The Twelve-Month Transformation

To understand the thesis, look at the delta.

December 2024: The SEC was suing Coinbase. The government was auctioning seized Bitcoin. Zero crypto laws existed. No state had ever purchased BTC with public funds. “Regulation by enforcement” was the policy.

December 2025: The GENIUS Act is law. The SEC has a Crypto Task Force. The government holds 325,000 BTC and won’t sell. Texas bought Bitcoin with taxpayer money. A market structure bill has 294 House votes.

This isn’t a news cycle.

This is regime change.

The rules of engagement between government and Bitcoin shifted more in twelve months than in the previous twelve years. Every correction, every drawdown, every “cycle death” panic is now happening against this backdrop.

Patient capital isn’t watching price. It’s watching policy. And policy changed.

Part 2: What’s Actually Law

GENIUS Act: Stablecoin Regulation ✅

Signed: July 18, 2025

The first major piece of crypto legislation in U.S. history.

Every stablecoin issuer must now hold $1 of qualifying reserves for every $1 issued. Qualifying reserves: cash, bank deposits, short-term Treasury bills, government money market funds. Mandatory audits. Executive certification. AML compliance.

Why it matters for Bitcoin:

Stablecoins are the plumbing. The $310 billion stablecoin market is what makes crypto trading liquid around the clock. When you buy the dip, you’re converting stablecoins to BTC.

Before this law, stablecoins operated in regulatory gray area. Institutional capital stayed cautious about infrastructure that could face sudden regulatory action.

Now there’s clarity. Required reserves. Mandatory audits. Legal framework.

The GENIUS Act is not a buy signal. It is a “don’t get sued” signal. For general counsels at Fortune 500s, that is the only signal that matters.

Citigroup projects the stablecoin market could reach $1.9 trillion (base case) to $4 trillion (bull case) by 2030. That’s the capital pool sitting adjacent to Bitcoin, legally secured and growing.

The GENIUS Act doesn’t move Bitcoin’s price directly. It secures the infrastructure that makes Bitcoin markets function.

Strategic Bitcoin Reserve ✅

Status: Active since March 6, 2025 (Executive Order)

The U.S. government holds approximately 325,000 BTC.

Policy: never sell.

This figure jumped in October 2025 when the DOJ announced forfeiture of 127,271 BTC from a Cambodian fraud operation. Combined with Silk Road, Bitfinex, and other seizures, the federal government now holds more Bitcoin than any corporation except MicroStrategy.

What changed:

Before this order, the government routinely auctioned seized Bitcoin. U.S. Marshals sales put hundreds of millions in unpredictable selling pressure on the market.

That selling pressure is gone.

325,000 BTC. Roughly $29 billion at current prices. Permanently removed from potential supply. More importantly: precedent. The U.S. government now treats Bitcoin as an asset worth holding.

Critical distinction: This is an Executive Order, not law. The GENIUS Act cannot be undone without Congress. The Strategic Reserve can be revoked with a signature. See Risk Factors for specific scenarios.

The government converted from seller to holder. That’s structural supply compression. But it’s compression by policy, not statute.

State Reserves ✅

Texas: Testing the Pipes

November 2025: Texas purchased $5 million in BlackRock’s iShares Bitcoin Trust. First state in American history to buy Bitcoin with taxpayer money.

$5 million against a $338 billion budget is 0.001%. Skeptics call it a PR stunt.

They’re missing the point.

Corporate treasuries didn’t start with billions. MicroStrategy started with $250 million. Then watched. Then scaled. Texas is running the pilot program. Testing custody. Testing accounting. Testing political blowback. The signal isn’t the dollar amount. The signal is that the process now exists.

If Bitcoin appreciates and Texas claims vindication, other treasurers face constituent pressure: why aren’t we doing this?

New Hampshire: Most Aggressive Authorization

House Bill 302 authorizes up to 5% of state funds for digital assets with market cap exceeding $500 billion. Only Bitcoin qualifies. If fully deployed: hundreds of millions in potential purchases.

Arizona: Limited Scope

House Bill 2749 created a reserve funded only through forfeitures, airdrops, and staking rewards. No direct purchases. Governor vetoed the more aggressive bill.

The Pattern:

State adoption is mirroring corporate treasury adoption from 2020-2021. Small test buys. Political cover established. Infrastructure proven. Then scale.

Part 3: What’s Pending

CLARITY Act: Market Structure

Status: Passed House 294-134. Senate negotiating.

This bill answers the question that’s haunted crypto since 2017: which tokens are securities (SEC) and which are commodities (CFTC)?

The bill gives CFTC exclusive jurisdiction over digital commodity spot markets. Creates registration pathways. Exempts certain DeFi protocols and wallet providers from SEC oversight.

Why it’s stuck:

Senate negotiations stalled over:

- Conflict-of-interest provisions (Trump family crypto holdings)

- Stablecoin yield treatment

- DeFi regulation approach

Timeline: Realistically 2026. Senate running out of calendar. Government shutdown risk in late January delays further.

What it means: When this passes (and bipartisan momentum suggests it will), U.S. exchanges can list tokens without existential lawsuit risk. The regulatory clarity that enabled ETF launches extends to the broader market.

BITCOIN Act (Lummis)

Status: Committee since March 2025. No movement.

Senator Lummis proposed a federal purchase program: 1 million BTC over five years. Holdings maintained for 20 years. Funding from Federal Reserve remittances. $6 billion annually.

If passed: the most significant demand driver in Bitcoin’s history.

Current reality: stalled. Republican co-sponsors but no advancement to markup or vote.

The BITCOIN Act matters as a signal of where policy thinking is heading, even if passage is unlikely this session.

Bitcoin for America Act

Status: Committee since November 2025. Very early stage.

Representative Davidson’s bill would allow federal tax payments in Bitcoin with zero capital gains on transfer. All BTC deposited into the Strategic Bitcoin Reserve.

No hearings scheduled. Just introduced three weeks ago.

The viral math claiming this creates “$260-520B annual inflows” is engagement farming. The Bitcoin Policy Institute models 1% adoption at roughly $52 billion annually. That assumes a bill that hasn’t left committee.

Part 4: The Structural Thesis

Every policy development shares a common market effect.

Supply compression.

Government holdings:

- Federal reserve: 325K BTC (was being sold, now holding)

- Texas: Buying and holding

- New Hampshire: Authorized to buy and hold

- Arizona: Holding forfeitures

Institutional holdings:

- ETFs: ~1.43 million BTC

- Corporate treasuries: 800K+ BTC (MicroStrategy: 660,624)

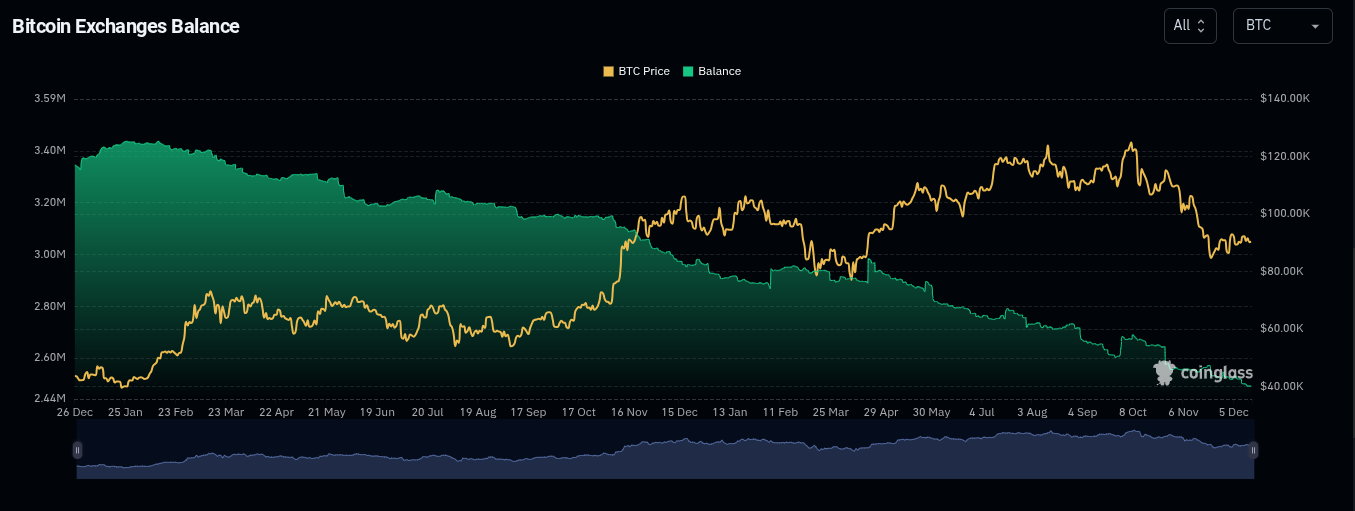

Exchange dynamics:

- Balances at multi-year lows

- Down 900,000+ BTC through 2025

The free float keeps shrinking.

The demand infrastructure keeps expanding.

The Historical Pattern

| Year | Policy Shift | What Followed |

|---|---|---|

| 2017 | CME futures approved | Institutional derivatives market born |

| 2020 | OCC allows bank custody | Corporate treasury adoption begins |

| 2024 | Spot ETFs approved | $100B+ inflows in first year |

| 2025 | GENIUS Act, Strategic Reserve, state adoption | ? |

Each regulatory milestone didn’t cause immediate price pumps. It created conditions for the next wave of adoption. Measured in years, not weeks.

2025’s policy shifts are laying groundwork for the next expansion phase.

The timeline is years.

The direction is set.

Part 5: Risk Factors

Budgetary capitulation: The Strategic Reserve is an Executive Order, not law. If the U.S. faces a debt ceiling crisis or budget emergency, 325K BTC sitting idle becomes a political target. The pressure to liquidate for deficit relief could become overwhelming. This is the highest-probability reversal scenario.

Political reversal: Any future administration can revoke the Executive Order. The GENIUS Act requires Congressional action to undo. The Reserve requires only a signature.

Legislative stall: CLARITY Act could remain stuck through 2026 or longer. Bipartisan momentum doesn’t guarantee passage.

State reserve failures: If Texas’s position loses significant value before other states act, it becomes a cautionary tale rather than a model. Political appetite for state reserves collapses.

Macro override: Severe recession could overwhelm structural tailwinds. Policy doesn’t matter if liquidity flees all risk assets.

Implementation gaps: Laws on paper don’t guarantee smooth execution.

Part 6: What This Means

The corrections feel like the old cycles.

The structure underneath is different.

U.S. policy regime changed more in 12 months than in the previous 12 years. Regulatory clarity improving. Supply compressing. Demand infrastructure expanding.

This doesn’t mean price goes up tomorrow. It means the conditions for sustained institutional adoption are stronger than they’ve ever been.

Patient capital isn’t panicking because they understand: volatility is the price of admission to a structural shift.

The infrastructure is being built.

The supply is compressing.

The demand channels are expanding.

The regime changed. The only question left is whether your portfolio has.

Legislation Summary

| Bill/Action | Status | Probability | Timeline |

|---|---|---|---|

| GENIUS Act | ✅ Law | Done | July 2025 |

| Strategic Bitcoin Reserve | ✅ Active (EO) | High but reversible | Active |

| Texas SB 21 | ✅ Funded | Done | Nov 2025 |

| New Hampshire HB 302 | ✅ Law | Done | Pending deployment |

| CLARITY Act | Senate | Moderate | 2026 |

| BITCOIN Act | Committee | Low | No momentum |

| Bitcoin for America Act | Committee | Low | Very early |

Sources: Congress.gov | Arkham Intelligence | DefiLlama | CoinDesk | Bitcoin Magazine | Citi Institute | Official state announcements

This analysis is educational commentary, not financial advice. Cryptocurrency investments carry significant risk. Past policy developments do not guarantee future outcomes.