The Fall of Do Kwon: A $40 Billion Tragedy in Three Acts

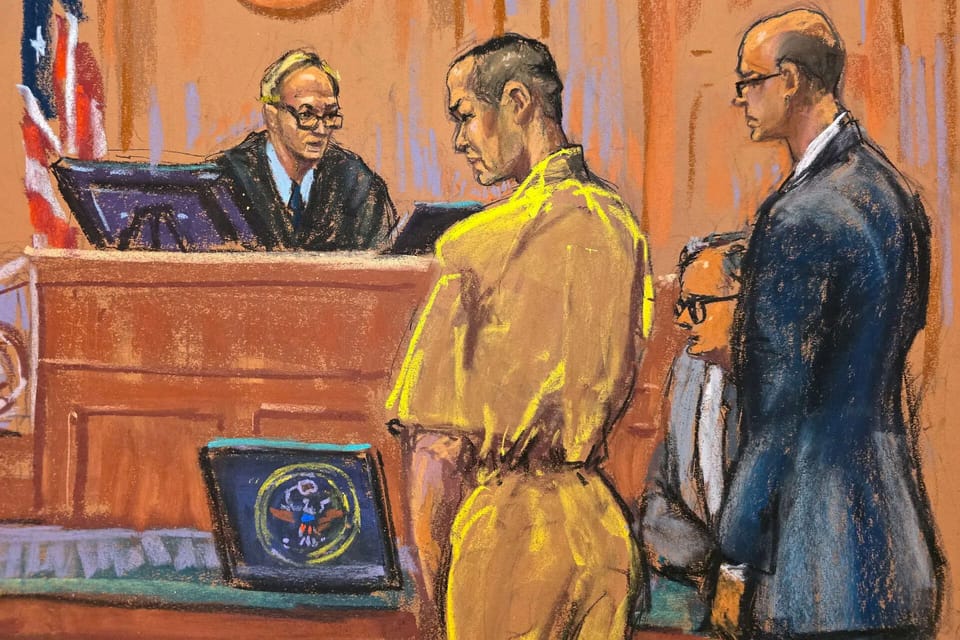

Prologue: The Courtroom

Manhattan. December 11, 2025. A federal courtroom in the Southern District of New York.

Do Kwon sits at the defense table in a yellow jail suit. He is 34 years old. Three years ago, he commanded a $60 billion empire and dominated crypto Twitter. Today, he listens as victims describe what he did to their lives. One speaks by telephone from Croatia. He moved back in with his parents after the crash evaporated his family’s savings. His wife divorced him. His sons skipped college. Everything he had went into Terra.

More than 315 victim impact statements sit before Judge Paul Engelmayer. One describes contemplating suicide after watching his father lose his retirement. Another explains that $11,400 might seem like just a number, but it represented years of effort. Gone overnight while juggling bills and trying to finish college.

The prosecutor reads excerpts aloud. The hearing stretches across the entire day.

When Kwon finally speaks, he cries. He mentions his wife. His four-year-old daughter. He says he’s spent every waking moment of the last few years thinking about what he could have done differently.

Judge Engelmayer is unmoved.

He calls the government’s recommended 12-year sentence “unreasonably lenient.” He calls the defense’s request for five years “utterly unthinkable and wildly unreasonable.” So implausible it would require appellate reversal if imposed.

Then he delivers the sentence: 15 years.

“This was a fraud on an epic, generational scale,” Engelmayer says. “In the history of federal prosecutions, there are few frauds that have caused as much harm as you have, Mr. Kwon.”

He quotes the historian Robert Caro on power: that it reveals who someone truly is.

Then he reads back a tweet Kwon posted in July 2021, when a critic questioned the stability of his algorithmic stablecoin:

“I don’t debate the poor on Twitter, and sorry I don’t have any change on me for her at the moment.”

“I found that moment revealing,” Engelmayer says, “about who you truly are.”

The judge notes that Kwon held an “almost mystical hold” over investors. That he caused incalculable “human wreckage.” That when investigators came asking questions, Kwon’s recorded strategy was to “tell them to fuck off.”

Fifteen years. More than prosecutors requested. The era of algorithmic hubris ends with a man in a yellow suit learning that arrogance has a price.

But to understand how we got here, we have to go back to the beginning.

Act I: The Architect

Do Kwon was born in Seoul on September 6, 1991. Bright kid. Elite high school. Daewon Foreign Language, one of Korea’s most prestigious prep schools. The kind of place that produces future leaders and, occasionally, future convicts.

He got into Stanford for computer science. Graduated in 2015. Did brief stints at Microsoft and Apple. Enough to put on a resume, not enough to stay. Silicon Valley wasn’t big enough for what he wanted to build.

Back in Seoul by 2016, Kwon founded Anyfi, a mesh networking startup. It went nowhere interesting. But it introduced him to the architecture of decentralized systems and to the wild west of cryptocurrency, where a smart kid with audacity could build something from nothing.

In January 2018, Kwon co-founded Terraform Labs with Daniel Shin, a successful Korean entrepreneur who’d built and sold Ticket Monster for hundreds of millions. Shin brought legitimacy and connections. Kwon brought the vision.

The pitch was elegant: a stablecoin that didn’t need banks.

Most stablecoins maintain their dollar peg by holding actual dollars in reserve. Tether, USDC. One token, one dollar backing it. Simple but centralized. Dependent on traditional finance.

Kwon wanted something purer. An algorithmic stablecoin called TerraUSD (UST) that would maintain its $1 peg through code alone. The mechanism worked like this: UST was paired with a floating cryptocurrency called Luna. When UST traded above $1, arbitrageurs could mint new UST by burning Luna, increasing supply until the price fell back to peg. When UST traded below $1, holders could burn UST for $1 worth of Luna, decreasing supply until the price rose.

Elegant. Self-correcting. Revolutionary.

Or so the theory went.

The money poured in. Terraform Labs raised $32 million from crypto heavyweights like Binance, Polychain Capital, and Arrington XRP. The Terra blockchain launched. The ecosystem grew. By 2019, Kwon made Forbes’ 30 Under 30 Asia list. Korean media called him a genius. Thousands of retail investors lined up to give him their savings.

But it was Anchor Protocol that supercharged everything.

Anchor launched in March 2021 as Terra’s flagship DeFi application. Essentially a savings account for UST deposits. The yield: nearly 20% annually. On a stablecoin. Risk-free, or so Kwon claimed.

For context: the average U.S. savings account paid 0.07% at the time. The S&P 500’s historical average annual return is about 10%. And here was Do Kwon promising 20% on an asset pegged to the dollar.

Where did the yield come from? That was the question critics kept asking. The answer was complicated. Staking rewards, borrowing fees, algorithmic adjustments. But the uncomfortable truth was simpler: Terraform Labs was subsidizing the yield to drive adoption. In February 2022 alone, they injected $450 million into Anchor’s reserves to keep the 20% rate alive.

It was a growth hack masquerading as a financial product. And it worked spectacularly. By April 2022, Anchor held over $14 billion in deposits. More than 70% of all UST in circulation.

Luna hit an all-time high of $119.51 that month. The combined market cap of Terra and Luna exceeded $50 billion. Kwon’s personal net worth likely crossed $10 billion. His followers called themselves “Lunatics.” He was, by any measure, the king of DeFi.

And the arrogance started early.

When critics questioned whether a stablecoin backed by nothing but math could survive a crisis of confidence, Kwon didn’t engage. He dismissed. He mocked. He built an altar to his own certainty.

“I don’t debate the poor on Twitter.”

Screenshots that would haunt him.

When someone warned that UST could enter a death spiral (holders panic-selling, the burn mechanism flooding the market with Luna, Luna’s price crashing, making the burn mechanism worthless, accelerating the panic) Kwon waved it off. In November 2021, he dismissed the likelihood of such an attack outright.

To shore up confidence, the Luna Foundation Guard began accumulating Bitcoin reserves in early 2022. By May, they held over 80,000 BTC. Roughly $3 billion at the time. Kwon called it an additional layer of defense. He said it made UST “unbreakable.”

In April 2022, Kwon announced the birth of his daughter. He named her Luna.

“My dearest creation,” he tweeted, “named after my greatest invention.”

One month later, his greatest invention would destroy $40 billion in value and trigger a cascade of collapses that sent the entire crypto market into a two-year winter.

Act II: The Collapse

May 7, 2022.

A series of large UST sales hit Binance and Curve Finance. The amounts are significant. Over $285 million worth. But not unprecedented. UST dips to $0.985. A minor depeg. It’s happened before.

May 8, 2022.

UST falls further, hitting $0.98. The Luna Foundation Guard activates. They announce they’ll loan $750 million in Bitcoin to market makers to defend the peg, plus another $750 million in UST to buy back Bitcoin once volatility subsides.

Kwon tweets: “Steady lads, deploying more capital.”

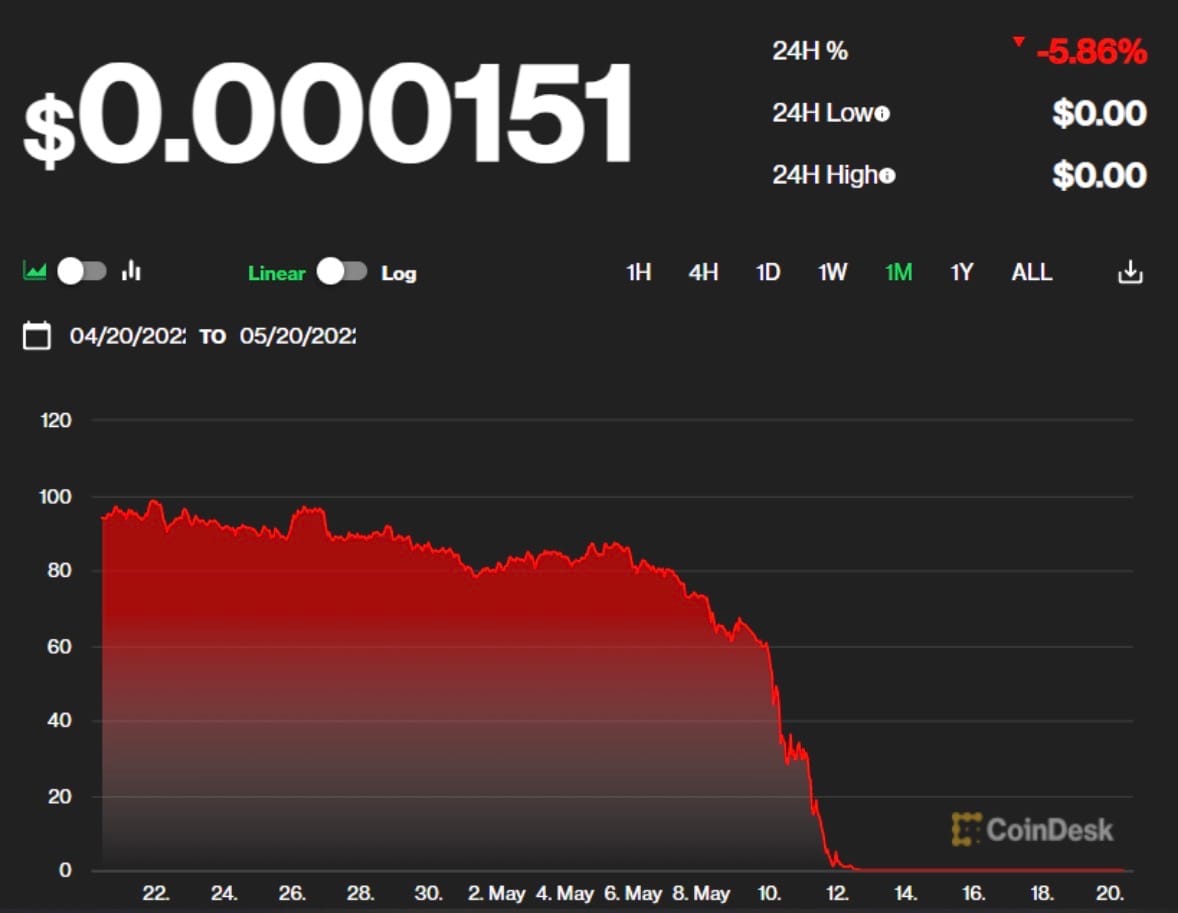

May 9, 2022.

The peg breaks.

UST plunges to $0.90. Then $0.80. Then $0.35. The arbitrage mechanism that’s supposed to restore the peg kicks into overdrive. But it’s working in reverse. Holders are burning UST for Luna, flooding the market with newly minted Luna tokens, crashing Luna’s price, which makes the Luna they receive for burning UST worth less, which accelerates the panic.

The death spiral that critics warned about. The one Kwon said couldn’t happen.

Anchor deposits hemorrhage. In 48 hours, $5 billion flows out of the protocol. The 20% yield that attracted all those deposits now looks like bait in a trap that’s closing.

May 10, 2022.

Luna falls below $30. It was $80 three days ago.

May 11, 2022.

Luna falls below $1. Then below $0.10. Exchanges begin halting trading. The token is in freefall so severe that price feeds can’t keep up.

May 12, 2022.

Luna trades at $0.0001. Effectively zero. UST stabilizes around $0.10. A 90% loss for holders who thought they were in a stable asset.

In Seoul, an investor who lost $2 million breaks into Kwon’s luxury condominium building. He demands an apology. Kwon’s wife calls the police and requests emergency protection.

On Reddit, moderators of r/TerraLuna pin suicide hotline numbers to the top of the forum.

May 13, 2022.

Kwon breaks his silence. “I am heartbroken,” he tweets, “about the pain my invention has brought on all of you.”

The Human Cost

The aggregate number ($40 billion) is too large to comprehend. But the individual stories, as reported in Korean and Taiwanese media in the weeks following the crash, make it real.

In Taiwan, a 29-year-old man who reportedly invested $2 million in Luna watched his portfolio collapse to roughly $1,000 in 48 hours. According to local police reports, he fell from his apartment balcony. No suicide note was found. Just a text message about losing nearly everything.

In South Korea, a family of three went missing. Police recovered their car from the waters off Wando Island, 32 feet underwater. Inside: a father, mother, and their 10-year-old daughter. According to Korea JoongAng Daily, investigators found the father’s browsing history included searches for “Luna coin,” “sleeping pills,” and “ways to make an extreme choice.” Common Korean terminology for suicide. Direct causation was never officially confirmed.

In the United States, a man tells the court that his wife divorced him, his sons had to skip college, and he moved back to Croatia to live with his parents. His life savings. Gone in a stablecoin that was supposed to be stable.

A Harvard Business School graduate and research head named Remi Tetot tweets: “Like many of you I have been wiped out. I am not going to lie it hurts. I lost 100% of my capital invested in crypto.”

One investor admits to the court that he carries the guilt of persuading his in-laws, and hundreds of nonprofit organizations, to invest in Terra.

More than 315 victim statements. Lost homes. Abandoned education. Delayed medical treatment. Charities gutted. Retirement accounts emptied.

And beyond the individual losses: contagion.

Celsius Network, a crypto lending platform with heavy Terra exposure, freezes withdrawals in June. Files bankruptcy in July. $4.7 billion in customer funds, frozen.

Three Arrows Capital, a $10 billion hedge fund that invested heavily in Luna, collapses. Its founders flee to Dubai. The fund owes creditors $3.5 billion it can’t repay.

Voyager Digital, BlockFi. Dominoes falling.

And six months later, when FTX implodes in November 2022, the credit stress that began with Terra had already weakened the entire structure. Terra didn’t cause FTX. But Terra’s collapse accelerated the deleveraging and liquidity crunch that amplified every failure that followed.

The crypto market enters a brutal winter. Bitcoin falls from $47,000 to below $16,000. Trillions in total market capitalization. Gone.

All of it traces back to a stablecoin that wasn’t stable, a yield that wasn’t sustainable, and a founder who didn’t debate the poor on Twitter.

Act III: The Hunt

Do Kwon left South Korea before the crash.

By September 2022, South Korean prosecutors had issued an arrest warrant. Interpol followed with a red notice. An international alert to locate and provisionally arrest an individual pending extradition.

Kwon claimed he wasn’t “on the run.” In interviews, he said he couldn’t disclose his location for security reasons. He continued running Terraform Labs remotely. He continued tweeting.

He was in Singapore. Then Serbia. A country with no extradition treaty with South Korea or the United States. He rented a $2 million apartment in Belgrade. Formed a company under his own name. Lived openly despite being one of the most wanted men in crypto.

The arrogance never stopped.

When asked about his invalidated South Korean passport in an October 2022 podcast interview, Kwon shrugged. “I wasn’t using it anyway.”

When South Korean investigators tracked him to Serbia and asked local authorities to detain him, Kwon moved. Montenegro. Another country he apparently believed was safe.

It wasn’t.

March 23, 2023. Podgorica Airport, Montenegro.

The end of the run.

Do Kwon and Han Chang-joon, Terraform’s former CFO, attempt to board a private jet bound for Dubai. They’re carrying forged Costa Rican passports. Montenegrin police find falsified Belgian documents hidden in their luggage.

They’re arrested on the tarmac.

The man who told critics he didn’t have change for them was caught fleeing with fake papers, three laptops, five phones, and the remaining shreds of an empire built on promises he couldn’t keep.

Montenegro sentenced him to four months for document fraud. Then began the extradition battle. South Korea and the United States both wanted him. The U.S. won.

On December 31, 2024, Kwon landed on American soil. Eight months later, he pleaded guilty to two counts: wire fraud and conspiracy to commit wire, securities, and commodities fraud.

Epilogue: The Verdict

Judge Engelmayer’s 15-year sentence positions Do Kwon among the most severely punished financial fraudsters in recent history. Alongside the prison term, Kwon was ordered to forfeit over $19 million in proceeds from his schemes. No formal restitution was ordered, a reflection of the logistical impossibility of making hundreds of thousands of victims whole from assets that represent a fraction of a percent of total losses.

For comparison: Elizabeth Holmes received 11 years for Theranos. Sam Bankman-Fried received 25 years for FTX. Bernie Madoff received 150 years for his $65 billion Ponzi scheme, though he was 71 at sentencing. Prosecutors argued that Kwon’s fraud exceeded the combined losses from FTX and OneCoin.

Kwon is 34. Under federal sentencing guidelines, he’ll serve approximately 85% of his sentence before becoming eligible for release. Roughly 12-13 years, assuming good conduct.

But his legal exposure doesn’t end there. South Korea still wants him. He faces additional charges that could carry decades more. Under his plea agreement, he can apply for transfer to South Korea after serving half his U.S. sentence. What awaits him there may be worse.

The judge rejected Kwon’s request to serve his sentence in South Korea immediately. To be closer to his wife and daughter, the child named Luna, who will grow up without her father.

Engelmayer said he was sympathetic to the daughter. He did not extend that sympathy to her father.

What It Means

Do Kwon didn’t invent algorithmic stablecoins. He didn’t invent unsustainable yield farming. He didn’t invent the particular brand of tech-bro arrogance that treats criticism as evidence of the critic’s inadequacy.

But he embodied all of it at scale. And he did it while lying.

The fraud wasn’t just that the algorithm failed. It’s that Kwon knew it was failing and lied about why it recovered. When UST briefly depegged in May 2021, Kwon told investors the algorithm had restored stability on its own. In reality, he’d secretly arranged for a trading firm to buy millions of dollars worth of UST to artificially prop up the price.

When the real crisis came a year later, he was still publicly telling retail investors to hold while insiders began exiting.

The judge used a word that prosecutors rarely reach for: “despicable.”

This case will shape how regulators approach algorithmic stablecoins, DeFi yields that seem too good to be true, and the cult-of-personality founders who promise revolution while building on foundations of sand.

But for the victims (the families destroyed, the retirements erased, the people who searched for Luna and sleeping pills in the same browser session) no sentence will make them whole.

The man who named his daughter after his greatest invention will spend the next 15 years thinking about what that invention cost.

The era that began with a Stanford kid who didn’t debate the poor on Twitter ends with a convicted felon in a yellow jail suit, sentenced for fraud on an epic, generational scale.

The algorithm couldn’t save him.

Nothing could.