The Great Bitcoin Supply Squeeze

How nations are locking up 14% of supply

Pierce & Pierce Research | December 2025

Last Updated: December 12, 2025 | This report is updated monthly

TL;DR: The U.S. government now holds 328,372 BTC (~$30B) and has stopped selling. Combined institutional holdings (ETFs + corporates + sovereigns) exceed 14% of Bitcoin's fixed supply. Exchange balances have dropped to 2.50M BTC — down 900K this year.

📋 Analytical Framework: This brief consolidates on-chain data, legislative status, and game theory into a "supply squeeze" thesis. We separate confirmed facts (data) from probabilistic assessments (policy outcomes). The core thesis depends on legislative follow-through. Treat policy projections as probabilities, not certainties.

On March 6, 2025, President Trump signed an executive order establishing the United States Strategic Bitcoin Reserve. This was the first formal recognition of Bitcoin as a sovereign reserve asset by a major economy.

This is our analysis of what this policy shift means for Bitcoin's supply dynamics and your investment positioning.

The Bottom Line

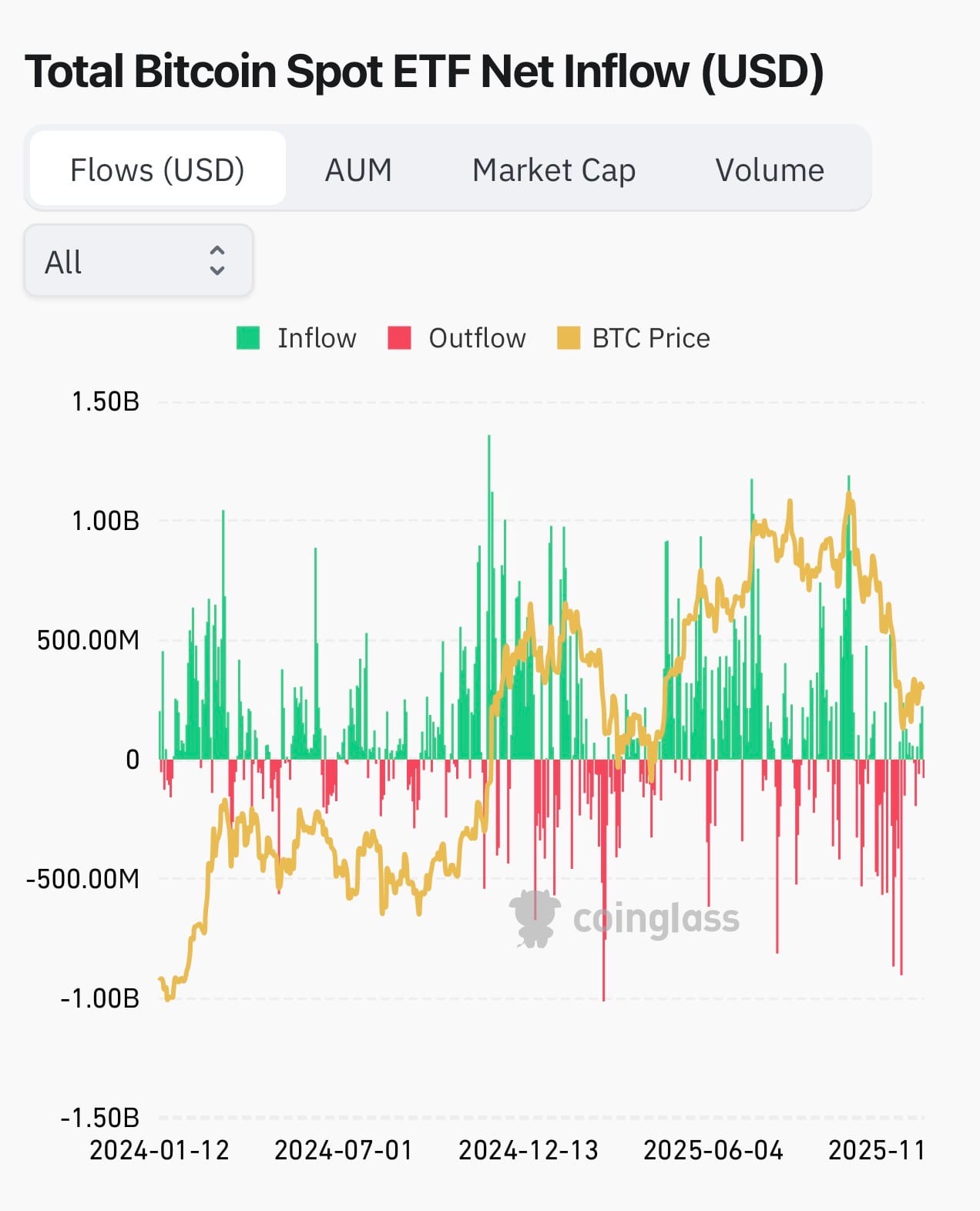

Nation-states now hold 582,617 BTC (2.77% of max supply). ETFs hold another ~1.35M BTC. Corporate treasuries add ~1M BTC more.

Combined institutional holdings exceed 14% of Bitcoin's fixed supply. The accumulation is broadening.

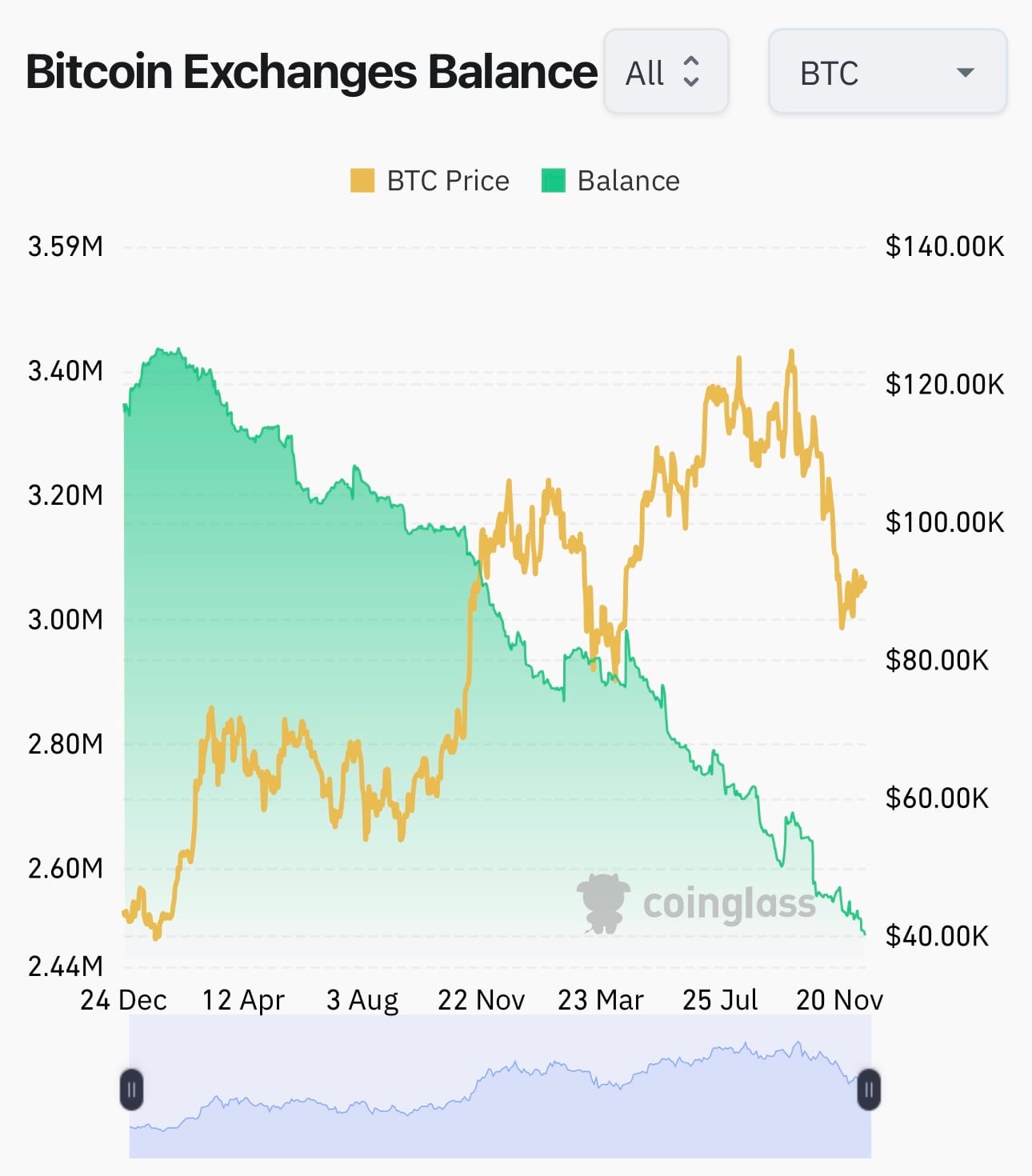

Meanwhile, exchange balances have declined materially to 2.50M BTC, down from 3.4M at the start of 2025. Nearly 900,000 BTC have left exchanges this year alone.

The arithmetic is straightforward: Structural demand is rising against structurally constrained supply.

Key Findings at a Glance

| Finding | Status | Implication |

|---|---|---|

| U.S. holds 328,372 BTC | ✅ Confirmed | Currently not selling (EO revocable) |

| Exchange balances declining | ✅ Confirmed | 2.50M BTC, down 26% YTD |

| BITCOIN Act (1M BTC purchase) | 🟡 In Committee | Persistent bid against shrinking float |

| Texas/NH reserves signed | ✅ Law | State-level accumulation beginning |

| Arizona passed limited bill | 🟡 Limited | Unclaimed assets only, not active buying |

| China holds 190,000 BTC | 🟡 Unconfirmed | Competitor if retained; risk if dumped |

| Game theory favors early movers | ✅ Active | Prisoner's dilemma dynamics |

| EO permanence | 🟡 Uncertain | Requires legislation to become durable |

Critical Policy Warning

⚠️ EO ≠ LAW: The Strategic Bitcoin Reserve was established by Executive Order, not legislation. A future administration can reverse this policy instantly. The 328,372 BTC is "currently not for sale", not "permanently locked." Without the BITCOIN Act passing Congress, this thesis carries significant execution risk.

⚠️ Key Risks to the Thesis

| Risk | Probability | Impact |

|---|---|---|

| Administration reverses EO | 🟡 Medium | High. Restores sell pressure. |

| BITCOIN Act fails to pass | 🟡 Medium | High. Thesis depends on legislation. |

| China dumps to harm U.S. | 🟡 Possible | High. Short-term price crash. |

| Political backlash kills momentum | 🟡 Medium | High. If seen as dollar weakness. |

| Volatility shakes conviction | ✅ Certain | Medium. 30-50% drawdowns normal. |

Bottom line: This thesis is a probability, not a certainty. The supply squeeze math is real, but it depends on policy durability.

1. The Policy Framework

Executive Order (March 6, 2025)

Trump's executive order established two entities:

Strategic Bitcoin Reserve

- Permanent reserve asset

- Funded by seized/forfeited Bitcoin

- No sales permitted (except victim restitution)

- ~328,000 BTC locked in

Digital Asset Stockpile

- Non-Bitcoin assets

- Treasury may sell these

- Separate from Bitcoin reserve

"Premature sales of bitcoin have already cost U.S. taxpayers over $17 billion." — White House Fact Sheet

What this means: The U.S. government has stopped selling. That's $30+ billion of potential sell pressure removed from the market. For now.

Source: WhiteHouse.gov

Pending Legislation

BITCOIN Act (S. 954) - Sen. Lummis

| Provision | Detail |

|---|---|

| Purchase target | 1 million BTC over 5 years |

| Annual rate | 200,000 BTC/year |

| Supply impact | ~5% of max supply |

| Funding | Fed surplus remittances ($6B/yr) |

| Hold period | 20-year minimum |

| Status | 🟡 In Banking Committee |

Co-sponsors: Senators Justice, Tuberville, Marshall, Blackburn, Moreno

2. State-Level Action

Two states have signed Bitcoin reserve legislation into law. Arizona passed a limited version:

| State | Bill | Status | Key Provisions |

|---|---|---|---|

| Texas | SB 21 | ✅ Signed | 1% of surplus to BTC; 5-year hold |

| New Hampshire | HB 302 | ✅ Signed | Invest in assets >$500B cap |

| Arizona | HB 2749 | ✅ Signed | Unclaimed crypto only (no active buying) |

| Arizona | SB 1025 | ❌ Vetoed | 10% of funds. Vetoed by Gov. Hobbs. |

| Oklahoma | HB 1203 | 🟡 Failed Senate | Passed House 77-15 |

Note: Arizona's HB 2749 is more limited than Texas/NH. It only holds abandoned/unclaimed digital assets, not active treasury investment.

The pattern: States with energy surpluses (Texas) or libertarian governance (NH) are first movers. Watch for similar legislation in comparable states.

Source: bitcoinlaws.io, state legislature records

3. Nation-State Holdings

Who Owns What

| Country | BTC | Value | % of 21M |

|---|---|---|---|

| 🇺🇸 United States | 328,372 | $30.4B | 1.56% |

| 🇨🇳 China * | 190,000 | $17.6B | 0.90% |

| 🇬🇧 United Kingdom | 61,245 | $5.7B | 0.29% |

| 🇺🇦 Ukraine | 46,351 | $4.3B | 0.22% |

| 🇧🇹 Bhutan | 11,286 | $1.0B | 0.05% |

| 🇸🇻 El Salvador | 7,475 | $691M | 0.04% |

| 🇩🇪 Germany | 0 | $0 | Sold 2024 |

| TOTAL | 582,617 | $53.9B | 2.77% |

Source: BitcoinTreasuries.NET, December 2025. Aggregate total (582,617 BTC) used for all calculations; individual country figures reflect latest available data per source and may not sum exactly due to differing snapshot timestamps.

Notable Dynamics

🇩🇪 Germany sold ~50,000 BTC in 2024. Widely criticized as premature. The White House explicitly referenced this mistake.

🇧🇹 Bhutan accumulates through state-run hydroelectric mining. Holdings fluctuate with ongoing operations.

🇸🇻 El Salvador recently restructured holdings across 14 wallets (max 500 BTC each) as a quantum security precaution.

🇨🇳 China is the wildcard. Three scenarios:

- If they retain holdings: The U.S. faces a near-peer competitor. Any U.S. accumulation must account for China's existing position.

- If they've liquidated: The U.S. has first-mover advantage among major economies. But China could reverse course.

- Asymmetric warfare: China could dump its holdings to crash the price and harm the U.S. position if Bitcoin becomes a formal U.S. strategic asset.

⚠️ The analysis community often assumes China must hold or accumulate. But "dump to damage the adversary" is a valid strategic option. A rapid liquidation of 190K BTC over days could plausibly trigger a 20-40% near-term drawdown based on historical large-seller absorption; a slower OTC unwind over months would have muted impact.

4. The Game Theory

The Prisoner's Dilemma

Once the U.S. formally designates Bitcoin as a strategic asset, other nations face a classic dilemma:

| Strategy | Cost | Risk |

|---|---|---|

| Accumulate now | Higher immediate cost | Secures supply; maintains parity |

| Wait | Lower immediate cost | Much higher cost later if others move |

| Reject entirely | Zero cost | Maximum strategic risk |

The Nash equilibrium trends toward accumulation.

Once one major player commits, the rational response for others is to accumulate rather than risk being left behind.

This is what happened with gold after Bretton Woods collapsed in 1971.

Historical Precedent

Central banks today hold ~36,000 tonnes of gold (~$5 trillion at current prices).

If Bitcoin captures even a small fraction of this "store of value" allocation, the supply math becomes severe:

- Gold: Ongoing mining production adds supply

- Bitcoin: Fixed 21 million cap, diminishing issuance

5. The Supply Squeeze

Current Distribution

| Category | BTC | % of 21M |

|---|---|---|

| Maximum Supply | 21,000,000 | 100% |

| Circulating | 19,960,000 | 95.0% |

| On Exchanges | 2,500,000 | 11.9% |

| In ETFs | 1,350,000 | 6.4% |

| Nation-States | 582,617 | 2.8% |

| Corporate Treasury | ~1,000,000 | 4.8% |

| Daily Issuance | ~450/day | ~164K/yr |

Sources: Coinglass (Dec 11, 2025), BitcoinTreasuries.NET

The Free Float Problem

Exchange balances (2.50M BTC) represent where spot price discovery happens. But headline balances overstate what's actually available.

Why headline balances overstate free float: A growing share of exchange/custody BTC is structurally sticky — ETF custody, collateral, dormant balances, and market-maker inventory. The relevant constraint is not the 2.50M headline figure, but the marginal sell-side liquidity available at the market-clearing price.

Committed institutional holdings include:

- ETF holdings (custodied on exchanges): ~1.35M BTC

- Nation-states: ~0.58M BTC

- Corporate treasuries: ~1.00M BTC

The dynamic that matters: Incremental institutional demand (ETF inflows, sovereign accumulation, corporate treasury allocation) is competing for a shrinking marginal free float. As committed capital grows, the pool of price-responsive supply compresses.

Importantly, "institutional holdings" are not synonymous with "permanently locked" coins — these holdings can be sold. The price-setting constraint is the marginal sell-side liquidity available when incremental demand arrives.

Scenario Analysis

| Scenario | BTC Absorbed | Absorption Timeline |

|---|---|---|

| EO only (status quo) | 328K held | Already locked |

| BITCOIN Act passes | +1M | 5 years (staggered, likely OTC-heavy) |

| States follow TX/NH | +50-100K | 2-3 years |

Key insight: Even partial passage of pending legislation would create sustained buy pressure against a structurally constrained float. The absorption would be cumulative, not instantaneous — but the direction is clear.

The Structural Squeeze

Multiple forces compressing supply simultaneously:

📉 Halving Effect Post-April 2024 issuance: ~450 BTC/day (down from ~900)

📉 Exchange Outflows 2.50M BTC on exchanges, down from 3.4M in January 2025 ~900,000 BTC left exchanges YTD

📈 Illiquid Supply Growing 14.3M BTC now "illiquid" per Glassnode (~72% of circulating)

"Over time, the scarcity of bitcoin may become the focal point as more entities buy and hold the asset long term." — Fidelity Digital Assets

6. Risks & Counterarguments

A balanced analysis requires acknowledging legitimate critiques.

Economic Critiques

University of Chicago Survey (Feb 2025) Zero economists agreed that a crypto reserve would benefit the U.S. economy.

Nic Carter Critique A Bitcoin reserve won't bolster the dollar. It may signal dollar weakness.

P&P Response: The investment thesis doesn't require Bitcoin to "bolster" the dollar. It rests on structural demand against fixed supply.

⚠️ This critique carries political risk. If the Reserve is perceived as weakening the dollar, it could trigger political backlash that kills the very legislation (BITCOIN Act) the thesis depends on. The economic debate isn't just academic. It shapes Congressional votes.

Digital Asset Stockpile Risk

The Executive Order created a separate "Digital Asset Stockpile" for non-Bitcoin assets (ETH, stablecoins, seized altcoins) which the Treasury may sell.

Why this matters: Large-scale liquidation of stockpile assets could temporarily drain liquidity from broader crypto markets, creating correlated selling pressure that indirectly impacts Bitcoin price. The BTC reserve itself remains untouched.

This is not a direct threat to the thesis, but a short-term volatility factor to monitor.

Political Risks

| Risk | Severity | Mitigation |

|---|---|---|

| Administration change | 🟡 Medium | Legislative codification |

| Congressional opposition | 🟡 Medium | Bipartisan crypto momentum |

| Regulatory uncertainty | 🟡 Medium | Market structure bills progressing |

Rep. Maxine Waters called the reserve "silly." Democrats remain generally skeptical.

Market Risks

| Risk | Current Status |

|---|---|

| Volatility | -28% from ATH ($126K → $90.5K) |

| Liquidity constraints | Accumulation becomes more expensive |

| Concentrated holdings | Future sale pressure risk |

Technical Risks

- Custody: Secure storage of ~$30B presents operational challenges

- Quantum computing: Long-dated holdings face theoretical cryptographic risk

El Salvador's wallet restructuring (max 500 BTC each) reflects quantum concerns.

7. Investment Framework

Core Thesis

The Strategic Bitcoin Reserve represents a structural shift in Bitcoin's demand profile. Treat it as a probability, not a certainty.

What's confirmed:

✅ U.S. won't sell its 328,000 BTC under current policy

✅ Post-halving supply is constrained (~164K BTC/year)

✅ Exchange balances are declining (structural trend)

What's probable but not guaranteed:

🟡 BITCOIN Act or similar legislation passes (requires Congress)

🟡 Other nations follow game theory logic (could defect instead)

🟡 Current administration policy persists (EO is revocable)

This is a multi-year thesis, not a trade.

Price volatility will persist. The current drawdown from ATH is normal by Bitcoin standards. The investment case rests on structural dynamics that unfold over years.

Position Sizing Principles

- Volatility tolerance: 30-50% drawdowns are historically normal

- Time horizon: Multi-year; supply squeeze thesis unfolds slowly

- Portfolio context: Correlation with traditional assets varies by period

Catalysts to Monitor

Near-Term (Q1 2026)

- Senate Banking markup on market structure

- Treasury accounting disclosure

Medium-Term (2026)

- BITCOIN Act progress (passage uncertain; still in committee)

- Texas/NH accumulation begins

Long-Term (2027+)

- Nation-state accumulation race

- Next halving (2028)

- ETF flow trajectory

Thesis Invalidation

Revisit this thesis if:

❌ Executive order reversed; government resumes auctions

❌ All legislative proposals fail with no replacement

❌ Major ETF redemptions reverse structural demand

❌ Exchange balances increase significantly

❌ Technical failure (protocol exploit, quantum breakthrough)

Summary

| Factor | Status | Direction |

|---|---|---|

| U.S. policy (EO) | ✅ Established | Bullish (but revocable) |

| Legislative pipeline | 🟡 Active | Bullish if passed |

| Nation-state holdings | ✅ Growing | Bullish |

| Exchange liquidity | ✅ Declining | Bullish |

| Supply dynamics | ✅ Tightening | Bullish |

| Political risk | 🟡 Material | Key variable |

| China scenario | 🟡 Uncertain | Could be adversarial |

| Volatility | 🟡 Normal | Expected |

The structural case for Bitcoin is strong from a supply/demand perspective. The policy layer carries execution risk.

Sovereign accumulation is beginning, not guaranteed to continue.

Methodology

Definitions:

"Institutional holdings" in this brief includes: U.S. spot ETFs, public-company treasuries, and disclosed sovereign holdings. It excludes estimates of lost coins, private fund holdings, and unverified claims.

Free Float Analysis:

We distinguish between exchange balances (headline figure) and marginal free float (BTC actually responsive to new demand). Exchange balances include ETF holdings custodied at Coinbase and other institutional capital that is committed but not actively traded. Not all exchange-held BTC is liquid — a material portion is dormant, collateralised, or market-maker inventory.

The supply squeeze thesis rests on flow dynamics: incremental institutional demand competing for a shrinking marginal float, not a static stock comparison.

This framework aligns with Glassnode's distinction between listed supply, active sell-side liquidity, and marginal price-setting supply.

Complementary Research:

This report focuses on policy and legislative analysis. For on-chain data and market impact modelling, see:

- Gemini/Glassnode: "Potential Impacts of a Strategic Bitcoin Reserve" (June 2025) — gemini.com/strategic-bitcoin-reserve

- Fidelity Digital Assets: "2025 Look Ahead" — fidelitydigitalassets.com

Data Sources

- Government: WhiteHouse.gov, Congress.gov, state legislatures

- On-Chain: Coinglass, Arkham Intelligence, CryptoQuant

- Market: Farside Investors, CoinGecko

- Treasury: BitcoinTreasuries.NET, Bitbo.io

- Research: Fidelity Digital Assets, Gemini/Glassnode, Bitcoin Policy Institute

This document is for informational purposes only and does not constitute financial advice. Pierce & Pierce Research is not a registered investment advisor. Cryptocurrency investments carry substantial risk. Past performance is not indicative of future results.

© 2025 Pierce & Pierce Research. All rights reserved.